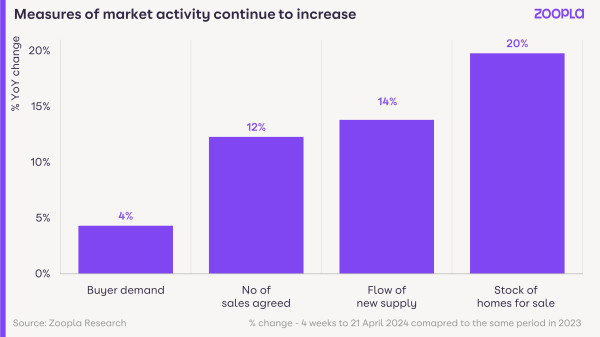

Buyer confidence is improving and 12% more homes are going under offer compared to this time last year. Mortgage approvals for home purchases are also up 32%.

The housing market is now more balanced than it was before the pandemic, which is good news for sellers, as it means more people have a chance of moving home in 2024.

The number of homes available for sale is continuing to grow but house price inflation remains broadly static.

And static house prices are good for buyers, who are already struggling to cope with a 60% increase in mortgage payments in 2024.

Meanwhile, more homes for sale and renewed buyer confidence means more sales are being agreed: in fact sales agreed are up 12% compared to this time last year.

And for the first four months of 2024, the number of homes going under offer has also been higher than in the first 4 months of 2023.

Our Executive Director of Research, Richard Donnell, says: ‘The housing sales pipeline is now rebuilding after a period of lower sales, when mortgage rates spiked higher in 2022 and 2023.

‘Our data shows that the housing market remains on track for 1.1m sales completions in 2024, up 10% on 2023.’

Mortgage approvals up more than 30%

Mortgage approvals for home purchases went up 32% year-on-year in February 2024, marking another return towards pre-pandemic levels.

‘The 4 to 6+ month time lag between agreeing a sale ‘subject to contract’ and moving in, means sales completion data is yet to register an upturn but this will emerge in the coming months,’ says Donnell.

House prices firming as market activity improves

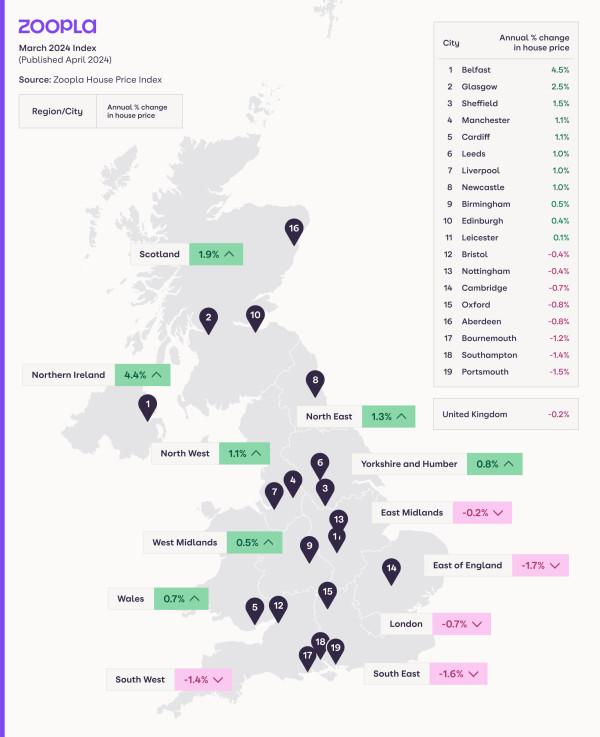

House prices are continuing to hold steady right now, and annual house price inflation is largely unchanged since last month. It currently stands at -0.2% at the end of March 2024.

‘House prices continue to fall, at a slowing rate, across five English regions covering southern England and the East Midlands, with prices down the most in the East of England (-1.7%),’ says Donnell.

‘However, in the north of England, West Midlands, Wales, Scotland and Northern Ireland, house price inflation has moved into positive territory, with prices in Belfast rising by 4.5%.’

Higher mortgage rates continue to affect buyer affordability

In southern England, where homes are more expensive, buyers are being hit harder by higher mortgage rates, low income growth and rising living costs.

This, in turn, is affecting house prices, as sellers set lower asking prices in order to attract a sale. Our data shows that 95-100% of homes in southern England are in markets where prices are currently falling.

However, at a national level, only 64% of homes are in markets registering annual price falls. Back in October last year, that number was much higher: 82%.

‘The scale of these price falls is relatively modest, in most cases between 0% and -3%,’ says Donnell.

‘We expect house prices to continue to firm over 2024 but we don’t expect house price inflation to start accelerating. The current trends in price inflation, and the divergence between the south and the rest of the UK, are expected to continue over the coming months.

‘Much depends on the outlook for interest rates and how this influences mortgage rates. Fixed rate mortgages today already reflect expectations for interest rate reductions in the future and we don’t expect any major changes in average mortgage rates over the rest of the year.

‘What the housing market needs most is continued price stability, which will create the right environment for continued growth in sales.’

To read the original article click here