The truth is, you can look at it either way. Here’s why there’s both good and bad news for homeowners in 2023.

There are two ways you can look at the housing market as a homeowner at the moment.

You could look at the glass as half full, and compare your home’s value against the pre-pandemic years.

Or you can look at the glass half empty, and compare current price trends to a year ago.

Let’s dive into the two perspectives and what it all means for you and your home.

Why are homeowners in a good position in 2023?

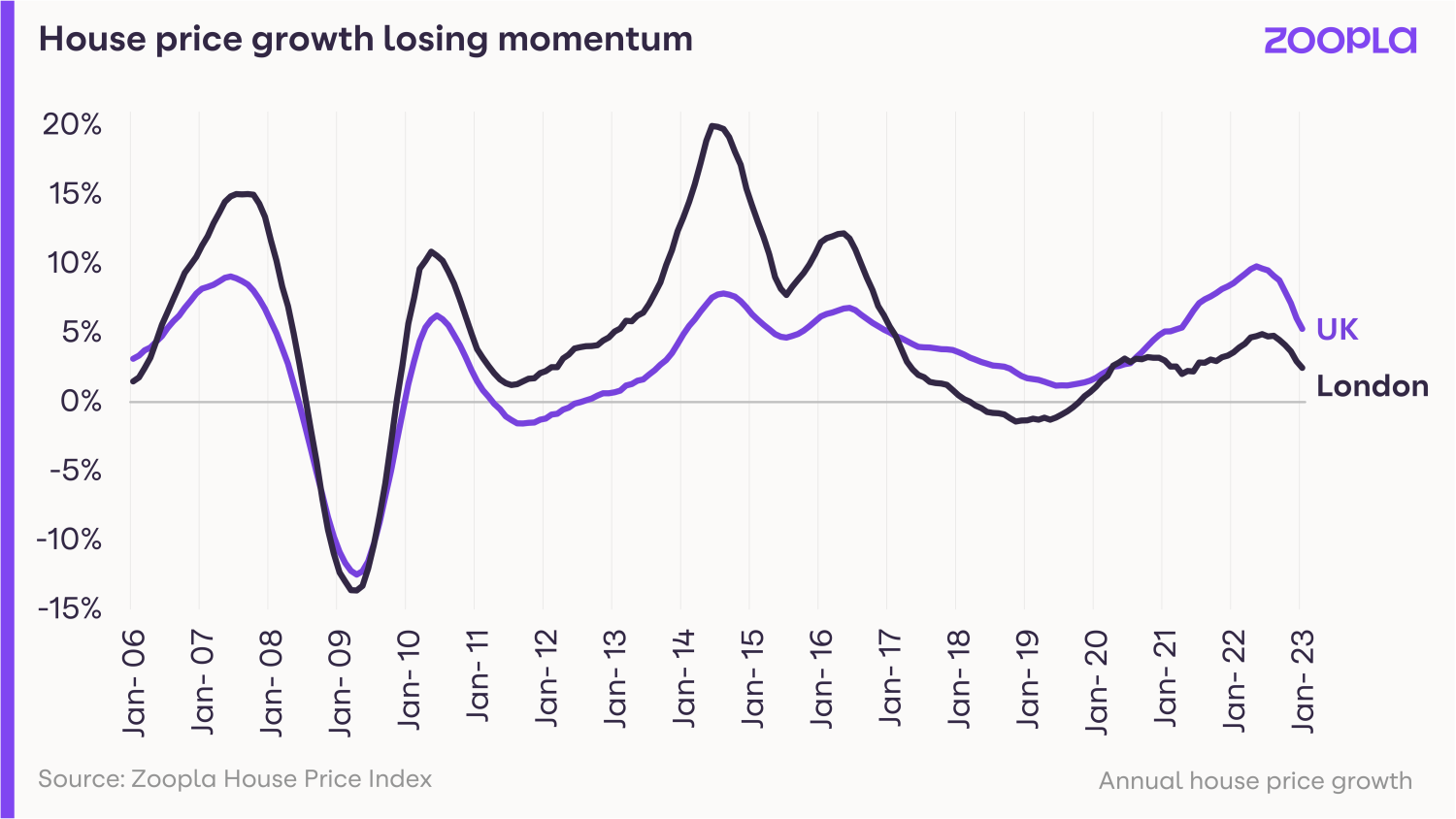

The average homeowner in the UK made £42,000 on their home between 2020 and 2022.

The pandemic gave a huge boost to house prices, making it the biggest housing boom in the UK since 2006.

This means your home’s sale price today would be £28,000 higher than in 2019 on average, despite the small monthly price falls we’re now seeing.

Our House Price Index uses more data than any other, so we’re able to give the most accurate picture of the UK housing market.

House Price Index – February 2023

We’re seeing the strongest house price growth in affordable towns within commuting distance to the UK’s major cities.

Prices are rising more than 8% year-on-year in places like Oldham, Dudley, Wolverhampton and Worcester, among others.

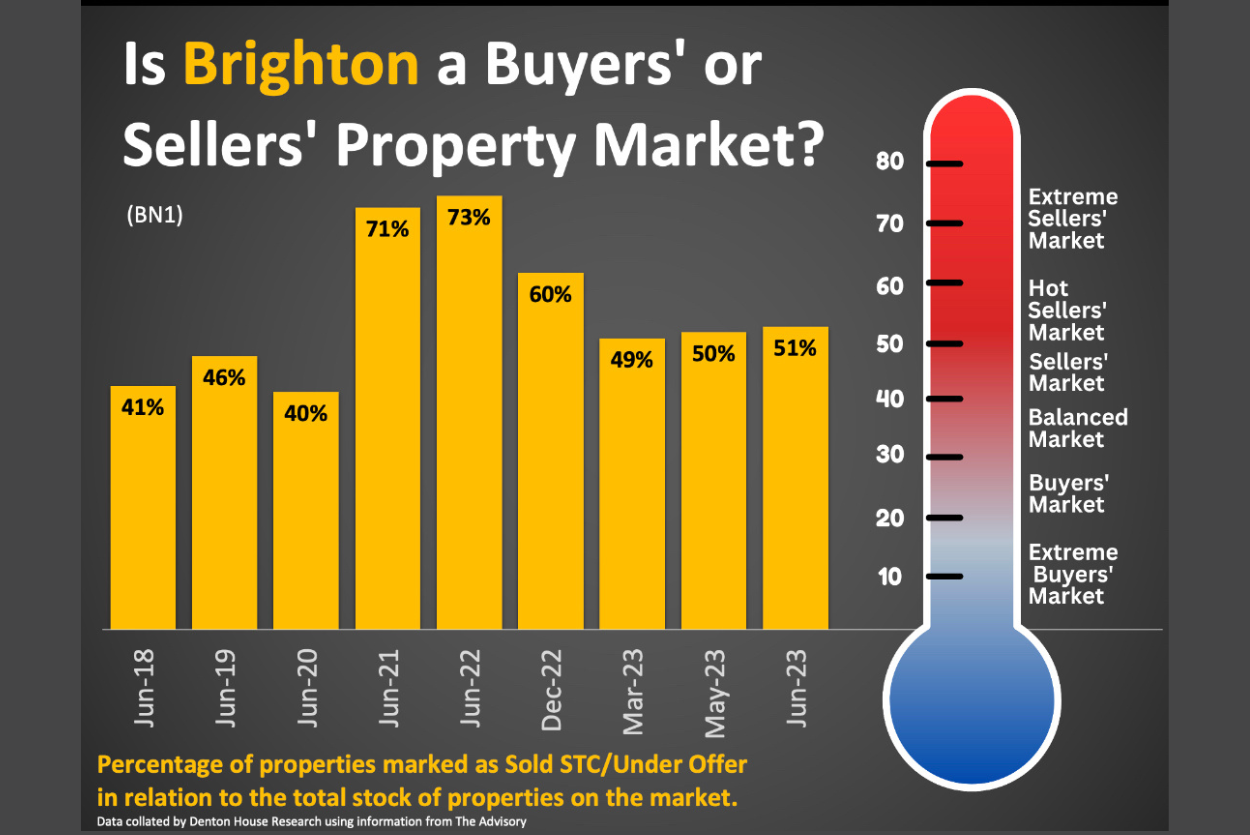

And other measures of housing market health are getting back on track too. Buyer demand and sale volumes have recovered in the last two months to match pre-pandemic levels.

In fact, affordable markets like the North East and Scotland are seeing more sales than before the pandemic, as high mortgage rates are having less of an impact in these lower value markets.

What’s the negative take for homeowners right now?

The pandemic house price boom has well and truly ended and a widespread repricing of homes is underway.

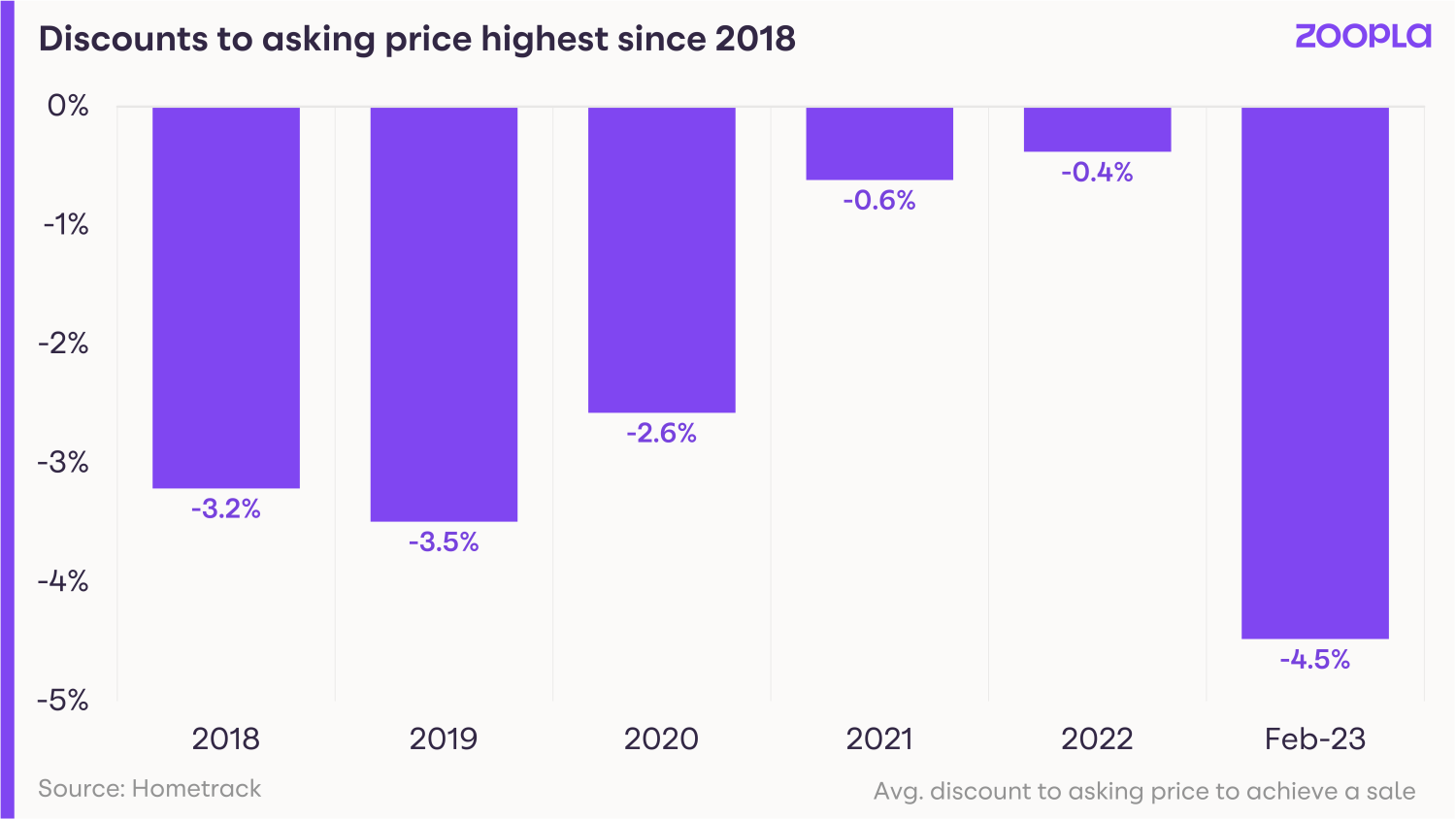

If you were to sell your home today, you’d likely need to offer buyers around a 4% to 5% discount off your asking price. That’s the average discount we’re seeing sellers make across the UK right now.

This equates to a third of the value you gained over the pandemic, or a discount of £14,100 off the average home.

That sounds like a lot of money – and it is.

It’s the largest gap we’ve seen between asking prices and sale prices for five years.

But if you’re a seasoned homeowner, you’ll know that negotiating an asking price was the done thing before the pandemic.

And the key difference now is that the price gains made over the last two years are a very healthy buffer, giving sellers room to negotiate and still walk away from a sale well into the black.

Going back to activity levels, buyer demand and sales numbers are between 20% and 50% lower than during the pandemic.

Should I be worried about my home’s value dropping?

We’re predicting a ‘soft landing’ of house prices – in other words, a drop of around 5% to sale prices between summer 2022 and summer 2023.

So a home that would’ve sold for £300,000 in August 2022 is likely to achieve a sale price of £285,000 in August 2023.

While you’ll always want to see your home’s value rising, remember that this change will only dent some of your pandemic gains – rather than what it was worth before that.

And the vast majority of homeowners will have much more than 5% equity in their home – even those who only bought last year.

So very few homeowners will need to worry about losing money when they sell after price falls of 5%.

Work out your equity in My Home

What’s to come for the housing market in 2023?

Several economic factors – and higher mortgage rates in particular – have come together to limit people’s motivation and ability to move house.

But the housing market can manage modest price falls, as long as some desire to move house remains this year.

And all the signs are showing that this demand will remain, says Richard Donnell, Research Director at Zoopla.

“Working from home, increased retirement and high immigration all continue to stimulate people to move home. And for some, cost of living pressures will exacerbate that need.

“What’s more, people are already adjusting to higher mortgage rates better than many feared. It’s welcome news to see more rates in the 4 to 5% range – and some even lower for those with a good loan-to-value ratio.”

Mortgage rates fall below 4% for lower loan-to-value mortgages

We don’t think mortgage rates will get much cheaper than this, but there’s competition among lenders to keep deals attractive for borrowers.

We’ve been saying for a while that 4% mortgage rates are manageable, and this rate is to be expected with the level of house price inflation we’re now seeing.

And if we see 1 million to 1.1 million sales in 2023 as we expect, it’ll be a positive year overall – for homeowners, buyers and sellers alike – after a tumultuous end to the last one.

To read the original article click here