It’s no secret that the property market has witnessed many unexpected trends this year, largely due many home-movers reprioritising their housing needs since lockdown.

We’ve seen a big rise in demand for rural areas, we revealed that people feel most content living on the coast, and there’s been a huge uptick in people looking for properties with home offices.

However, amidst all the new trends that’ve unfolded in 2020, we’ve seen more home-hunters looking to move than ever before.

In fact, the unanticipated market momentum of this year has led to average asking prices finishing 6.6% up on 2019.

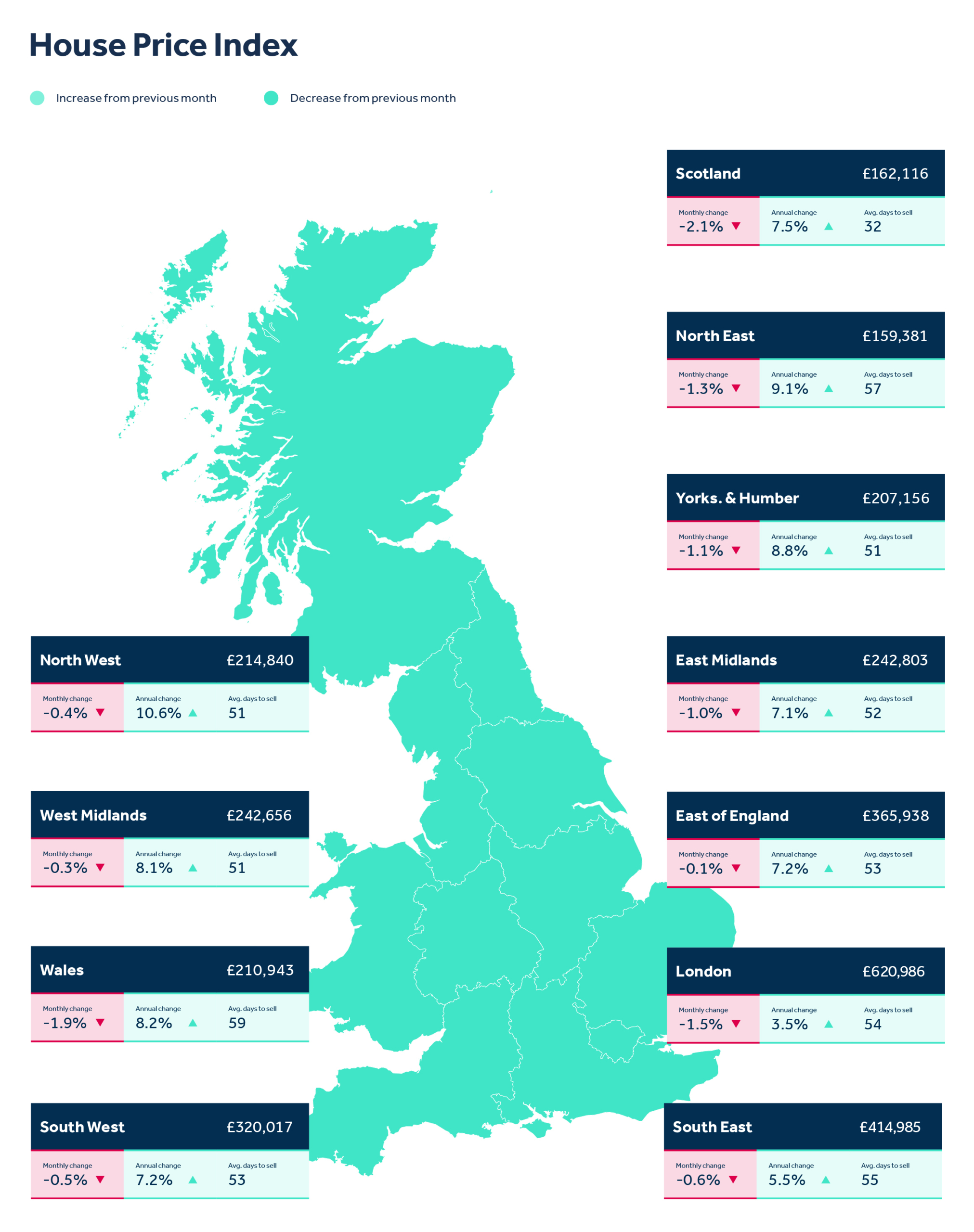

Despite a small monthly fall of 0.6%, average asking prices across the nation have risen £19,920 to £319,945 over the past 12 months.

The stamp duty holiday has undoubtedly added some extra momentum, but buyer demand was already very high prior to its announcement in July, and remains remarkably resilient at 53% higher than this time a year ago, despite the decreasing likelihood of completing a purchase by 31st March if it is agreed now.

Demand has therefore exceeded supply in 2020 with the number of properties coming to market for the year to date down by 0.6% on the same period in 2019, and the number of sales agreed up by 8.3%.

As a consequence the number of available properties for sale is at a record low, indicating scope for some further modest price increases overall in 2021.

Having the biggest home-hunting audience in the UK, we have unique insight into future demand for property, and this, alongside other evidence, underpins our believe that prices will continue to rise into next year.

What’s happened to asking prices in your region?

What do the experts say?

Our resident property data expert Tim Bannister explained that despite reservations around Brexit, the stamp duty holiday coming to an end, and pandemic-related uncertainties, there is still hope that we can return to some kind of normality in the latter part of 2021.

He said: “Despite these headwinds, ongoing demand still remains very high, indicating that there’s plenty of fuel left in the tank for the housing market. Interest rates remain at near-record lows, and we expect greater availability of low-deposit mortgages at competitive rates next year.

“These two factors will help to oil the wheels for home purchases by the ‘accidental savers’ who have collectively saved £100 billion that they couldn’t spend during the pandemic restrictions.

“With the expectation of a return to more normality in the second half of 2021 and a likely ‘fresh start’ mentality for some, there are sound reasons for continued positive market sentiment that will outweigh the economic, political, and health challenges ahead.

“Rural, countryside, and coastal demand will remain high for those re-appraising their lifestyle, but more normality will also help the recovery of those aspects of city-living that have seen a dip in their appeal.”

What are estate agents seeing?

Nick Leeming, chairman of Jackson-Stops, said: “The start of the new year is traditionally a busy time in the housing market, with buyers and vendors alike taking the festive period to plan for the year ahead.

“However, we are expecting the first months of 2021 to be particularly active as buyers try to squeeze in their deals before March 31st. Those looking to make savings on the stamp duty holiday must act now, we are advising any serious house hunters to have their offers in by January latest.

“Buyers and vendors alike at the prime and super-prime end of the market will continue to move throughout 2021 due to a change in lifestyle aspirations which have been spurred on by the COVID-19 pandemic.

“Many of these clients will be entering the housing market for the first time in decades as they haven’t had a pressing need to move or buy a second home so have held off doing so until now. Whilst the introduction of a viable vaccine will act as a shot to the arm for the housing market, restoring confidence at every level, the return of SDLT will slow transactions down at the lower end of the market although the top end will remain resilient.”

Marc von Grundherr, director of Benham and Reeves, added: “We’re certainly seeing a sprint finish this year where the UK property market is concerned. This has been primarily driven by government stimulation in the form of the stamp duty holiday, protecting the market against the traditional air of lethargy that comes as we approach the Christmas period, and keeping it fighting fit both where transaction levels and price growth are concerned.

“We expect to see this tidal wave of market momentum spill over into next year and keep the market buoyant, as homebuyers race to cross the line before Rishi Sunak’s chequered flag falls on the chance of a stamp duty saving.

“While the end of this initiative will lead to an understandable drop in demand over the months that follow, it will be more a return to pre-pandemic normality rather than a dramatic market crash. This will be largely due to the firm foundations laid this year which should enable strong and consistent growth throughout 2021.”

To read December’s House Price Index in full, click here.